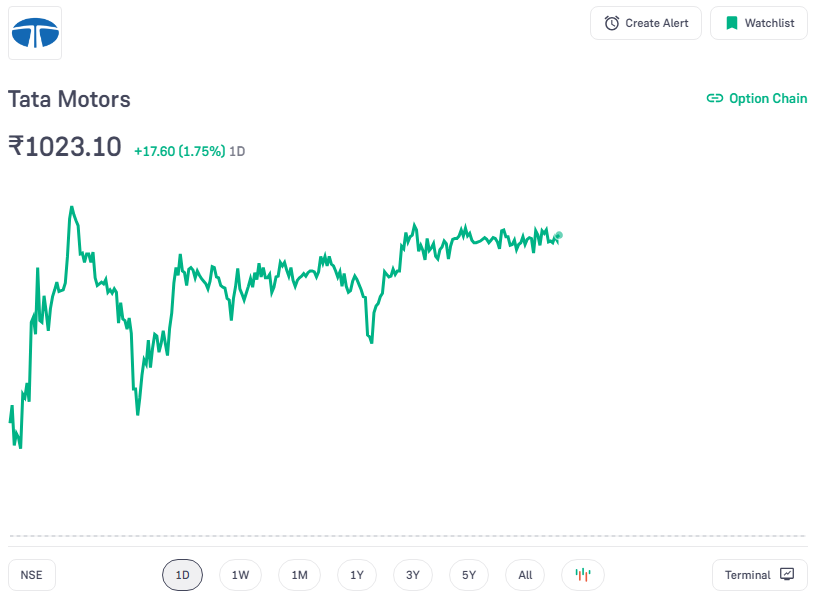

Tata Motors is gaining attention from analysts who are optimistic about its share performance in the short term. Technical analysis suggests that the stock could reach ₹1040.34 to ₹1065.60 soon. These targets are based on the current trading range and observed resistance levels, with the share price hovering near these critical points, indicating a potential breakout.

Short-Term Outlook

One of the key drivers of this optimistic short-term outlook is Tata Motors‘ strategic focus on the electric vehicle (EV) market. The company’s significant investments in EV technology and the acquisition of Ford’s Sanand plant to boost production capacity are expected to meet the growing demand for EVs.

Mid-Term Price Target

Looking ahead to 2025, analysts estimate Tata Motors’ share price could reach between ₹1437.68 and ₹1479.65. This projection is based on the company’s strengths in the automotive sector, especially its expanding EV portfolio.

Several factors contribute to this medium-term growth forecast

-

- Shift Towards Electric and Hybrid Vehicles: The global automotive market is shifting towards electric and hybrid vehicles, and Tata Motors is well-positioned to benefit from this trend.

-

- Global Expansion: Tata Motors is expanding its footprint in emerging markets, which is expected to boost sales volumes and profitability.

-

- Government Support: The Indian government’s supportive policies for EV adoption, including subsidies for buyers and tax benefits for manufacturers, create a favorable business environment for Tata Motors.

Long-Term Price Target

In the long term, the share price target for Tata Motors is even more bullish. By 2027, the stock may reach around ₹1865, and by 2029, it could climb to ₹2441. By 2030, some forecasts suggest the share price could rise to approximately ₹3780.30. These targets are based on optimistic assumptions about the company’s growth trajectory and market conditions.

Key factors driving long-term growth include:

-

- Aggressive R&D Investments: Tata Motors is heavily investing in research and development, focusing on advanced automotive technologies such as self-driving, connected vehicles, and next-generation EVs.

-

- Operational Efficiency: The company is implementing measures to streamline production processes and optimize its supply chain, leading to significant cost savings and higher profitability.

-

- Commercial Vehicle Demand: Tata Motors has a strong presence in the commercial vehicle sector, and global economic recovery is expected to boost demand for trucks, buses, and other commercial vehicles.

Risks and Considerations

Despite the optimistic outlook, potential risks and challenges must be considered

-

- Competitive Pressure: Tata Motors faces intense competition from both domestic and international players in the highly competitive automotive industry

-

- Regulatory Changes: Stricter emission standards and changing regulations related to EVs and conventional vehicles could impact Tata Motors’ operations and profitability.

-

- Macroeconomic Factors: Currency fluctuations, interest rates, and geopolitical tensions may affect Tata Motors’ business environment and financial performance.

Conclusion

Company has demonstrated flexibility and adaptability in the rapidly evolving automotive market. The company’s strategic focus on electric vehicles, global expansion, and investment in advanced technologies positions it well for future growth. Short- and medium-term price targets indicate significant potential gains, while long-term forecasts suggest even greater growth.

However, investors should remain mindful of the inherent risks and challenges in the automotive industry. Continuous monitoring of market conditions, regulatory developments, and the company’s strategic initiatives will be crucial for making informed investment decisions. Overall, Tata Motors presents an attractive investment opportunity with promising growth prospects in the coming years.

Future Targets

Share Target 2024 : ₹962 to ₹1046

Share Target 2025 : ₹1203 to ₹ 1307

Share Target 2026 : ₹1504 to ₹1634

Share Target 2030 : ₹3670 to ₹4000

Investing in Tata Shares is Good Decision, What are You waiting For Start Investing Today” Groww ”