Why should i invest in Tata Steel Limited, a longstanding business in metal mining, is a reputable large-cap company.Tata Steel is a big global player whose sales are come from diverse markets.

Geographical Markets: India, Europe and South Asia.

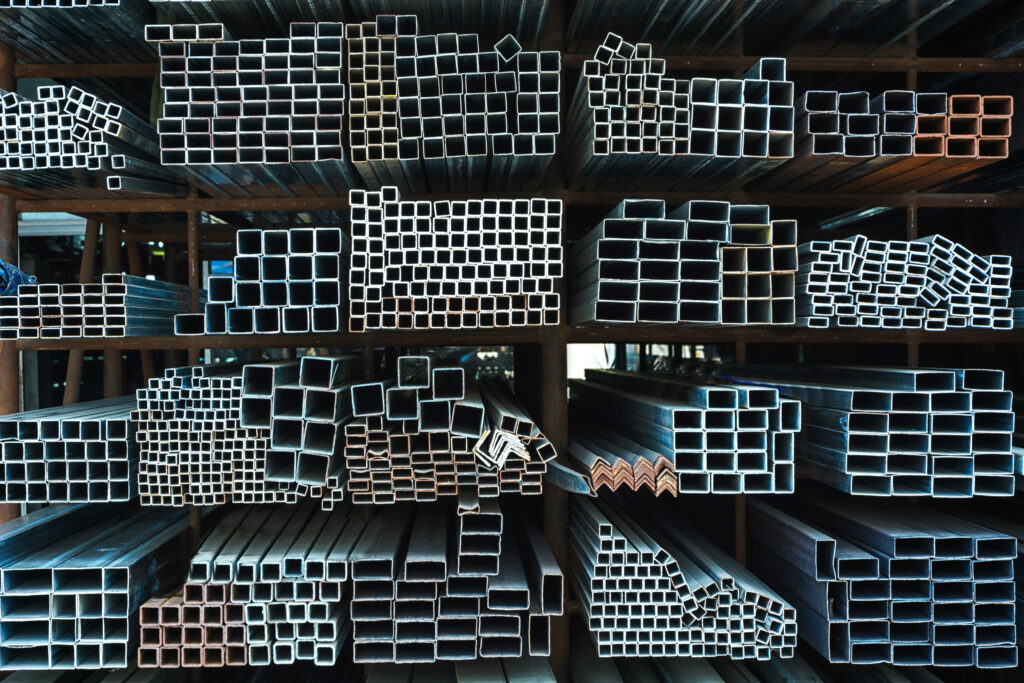

Product Segments: Automotive, Construction, Engineering, Packing.

Tata Steel Limited Operates on 28 Countries with around 80500 Employees. The steel is produced with advanced technology which makes it a high quality product and the companies that aim to be sustainable, reduce carbon emissions, and positively contribute to the country’s economy. Tata Group is very strict with its rules and regulations, which the Company has vowed not to break.The challenges Company faces include rising steel prices, competition, and constant pressure.

Why Invest In Tata Steel?

-

- Strong Iron Ore Price.

-

- Reputation of Company.

-

- Focuses in sustainability practice.

-

- Booking profits every quarter.

-

- We Get Dividend everyyear.

What is right time to invest in Tata steel?

Usually, it’s not a good idea to invest in steel stocks and keep them in your portfolio. However, NDMC Steel seems like a good choice right now and can be held for a long time.

Its current share price is suitable for long term investment.Just because I selected this stock does not mean that you should invest in it.Tata Steel a good popular stock: for a long time.

Should Focus on these stock.

So, I am focusing these sectors 1. IT 2. FMCG 3. Auto & Auto ancillary 4. Chemical 5.

Construction and engineering 6. FMEG 7. Banking (private) 8. Finance 9. Tata Motors 10.Rail.

Is Tata Steel a Good Choice for Long-Term Investment?

Yes !! You should focus on these Points after investing in it.

-

- Company is currently ranked second in the steel sector.

-

- The net profit is increasing from quarter to quarter.

-

- The company is growing its assets.

-

- Their cash flow is strong.

-

- Seventy-five percent of shareholders own their shares, including promoters and grant holders.

-

- The return on equity is 42%.

-

- Stocks that are yielding a good dividend of 4.75%.

Now, Come to Point Should i Buy For Long term investment in Tata Steel?

Yes, you can buy the app after holding it for 3-5 years. You worth buying for the long term. Additionally, you should keep this in mind if the price of Company drops or you see it at a lower rate and decide to buy it.

I would recommend that you consider this, as Tata Steel has signed a memorandum with the Ministry of Railways to manufacture seats for the Vande Bharat transit initiative.

Current Performance of the company:

-

- The market share value of Tata Steel is 218,150

-

- The pre-tax profit margin is above 20% which is great.

-

- An ROE of 35% is exceptional.

-

- The company has a reasonable 39% debt, which signals a healthy balance sheet.

-

- The EPS earnings are at 97, which is good news indicating consistent income for the company.

Tata Steel Over the last 5 years:

The revenue has increased annually by 16.87%, slightly below the industry average of 17.38%.

The market share rose from 31.22% to 33.03%.

Positive Points of Tata Steel.

-

- The current industry pay ratio of 13-14% is considered high and favorable when compared to remotely associated companies.

-

- The ROCE is 12.6% which is considered to be indicative of the size of the company.They have successfully achieved a 12-14% despite the pandemic.If

these trends continue, we will see very good growth for Tata Steel.

-

- It makes an excellent investment due to low EV and EBITDA ratios.

-

- I consider a ratio of less than 5 EV and EBITDA ratios for long-term investment, but its current ratio is 3.5 which is Good.

-

- With the PM Gati Shakti mission, Tata Steel is poised to receive substantial orders directly from the government, given the high demand for infrastructure projects.

Negative Points of Tata Steel.

-

- Tata Steel has a debt of 80,000 crore, which is a negative aspect.

-

- Tata Steel has not yet resolved the operational issues at its plant in the European market, which is contributing to the downward trend in its stock price.

-

- Due to the Russian-Ukrainian war, Tata Steel has had to increase its product prices, contributing to all-time high inflation levels. As a result, central banks may raise interest rates, which could negatively impact profits.